Offshore Company Formation Made Easy: Expert Tips for Entrepreneurs and Investors

Offshore Company Formation Made Easy: Expert Tips for Entrepreneurs and Investors

Blog Article

The Complete Overview to Offshore Business Formation: Actions and benefits

Offshore company development offers a tactical method for businesses and individuals looking for to maximize their financial and operational frameworks. The process needs mindful navigating through various steps, from figuring out details objectives to selecting a proper territory. What crucial factors should one prioritize to guarantee a successful offshore establishment?

Understanding Offshore Companies

Offshore companies are progressively acknowledged as critical lorries for people and organizations looking for to optimize their monetary and operational efficiencies. These entities are established in jurisdictions outside the owner's nation of house, usually characterized by favorable regulatory structures, tax obligation benefits, and improved privacy protections.

The primary objective of overseas business is to carry out international business while minimizing governing worries and direct exposure to regional tax. They can operate in numerous fields, consisting of money, innovation, and manufacturing. By utilizing overseas structures, entities can benefit from streamlined compliance procedures, minimized operational expenses, and the ability to accessibility worldwide markets better.

It is important to understand the lawful ramifications and demands connected with forming an offshore firm. Each jurisdiction has its own regulations controling the enrollment procedure, tax, and reporting commitments. Thorough due diligence is essential to guarantee conformity and minimize potential dangers.

In addition, the rationale behind overseas firm formation may differ significantly among people and businesses, affected by variables such as asset security, estate preparation, or market development. Recognizing these nuances is vital for educated decision-making in the realm of offshore operations.

Secret Advantages of Offshore Development

Developing an offshore company provides many benefits that can significantly enhance both personal and company monetary methods. Among the key advantages is tax optimization. Numerous offshore jurisdictions supply appealing tax obligation regimens, consisting of reduced or absolutely no corporate taxes, enabling companies to retain more profits and reinvest in growth.

Additionally, offshore firms often offer increased privacy and asset protection. In most cases, the possession information of overseas entities are not publicly disclosed, which can shield business proprietors from possible legal issues or unwanted analysis. This personal privacy can likewise protect personal properties from cases or obligations arising from organization tasks.

Last but not least, establishing an offshore business can boost integrity with customers and partners, especially in sectors where worldwide presence is valued. Generally, the vital advantages of overseas development consist of tax efficiency, enhanced privacy, possession security, operational versatility, and enhanced service reputation, making it a strategic choice for many entrepreneurs and investors.

Steps to Kind an Offshore Firm

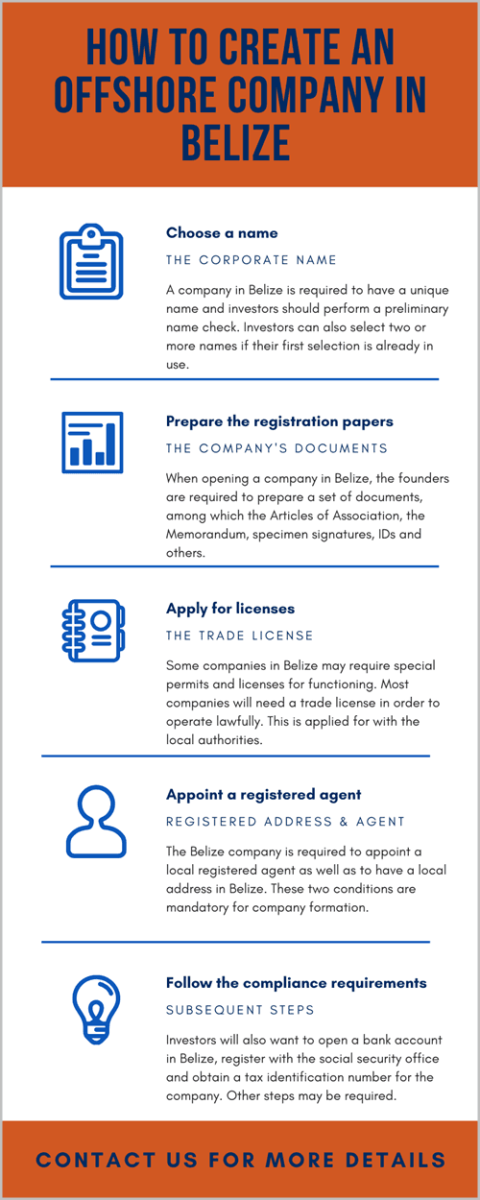

Just how can entrepreneurs navigate the procedure of forming an overseas business efficiently? The first action involves recognizing the certain objectives for developing an offshore entity.

The third action is preparing the necessary documents, which usually includes evidence of identity, proof of address, and a detailed service plan. As soon as the records are ready, the development agent will certainly assist in sending the application to the relevant authorities in the selected territory.

After the preliminary authorization, business owners need to open a business financial institution account. This step is essential for taking care of finances and making sure smooth business procedures. Continuous conformity is essential; this includes preserving precise documents, submitting annual returns, and adhering to any type of neighborhood regulations.

Choosing the Right Jurisdiction

Choosing the ideal jurisdiction is a critical decision that dramatically influences the success of an offshore company. The option of territory can impact taxation, regulatory compliance, personal privacy, and the overall convenience of operating. Different aspects ought to be taken into consideration in this procedure, including the legal structure, political stability, and financial atmosphere of the possible territory.

Tax is a primary consideration; some territories use desirable tax obligation prices and even tax obligation exceptions for find international organizations. Furthermore, it's important to evaluate the governing atmosphere, as some jurisdictions have much more rigorous requirements than others, which can make complex procedures. Personal privacy legislations also differ substantially; selecting a jurisdiction that safeguards firm info can be useful for privacy.

One more crucial factor to consider is the accessibility of specialist services, such as lawful and accounting support, which can facilitate the facility and ongoing management of the business. Take into consideration the reputation of the territory, as this can affect service connections and access to financial solutions. Careful evaluation of these elements will assist make sure that the chosen territory lines up with the critical goals and operational requirements of the offshore entity

Common Mistaken Beliefs Concerning Offshore Entities

Various mistaken beliefs surround offshore entities, typically leading to misconceptions concerning their purpose and legality. One prevalent misconception is that offshore business are only utilized for tax evasion. While it holds true that many individuals and organizations look for tax advantages, credible overseas territories abide by worldwide tax obligation laws and advertise transparency.

Another usual mistaken belief is that offshore entities are inherently unlawful. Actually, these frameworks can be entirely genuine when established for lawful functions such as property protection, estate planning, or international trade. offshore company formation. The stigma frequently connected with offshore firms comes from the activities of a minority that make use of these frameworks for illicit tasks

Finally, some think that offshore business are overly complex and inaccessible. In reality, with the ideal advice, the procedure can be simple, permitting organizations and individuals to browse the formation and compliance requirements successfully. Comprehending these mistaken beliefs is important for anyone thinking about offshore business development.

Verdict

In conclusion, overseas company development presents various advantages, including tax obligation optimization, privacy check improvement, and property defense. Ultimately, educated decision-making and mindful preparation are vital for making the most of the possibility of overseas business structures.

Offshore company development offers a strategic method for businesses and people looking for to optimize their economic and operational frameworks.The main purpose of offshore business is to carry out worldwide organization while lessening governing problems and exposure to local tax.Establishing an overseas firm uses countless advantages that can substantially boost both individual and organization monetary methods. Several offshore jurisdictions offer attractive tax obligation regimens, consisting of reduced or absolutely no corporate tax this post obligations, making it possible for business to preserve even more profits and reinvest in development.

Choosing the ideal territory is a pivotal decision that considerably affects the success of an offshore business.

Report this page